When we talk about the heaviest items to move, most people think about pianos and refrigerators. In reality, the heaviest thing may be the amount of paper in your home. One piece of paper weighs only about 5 grams, but it adds up if each filing cabinet drawer is stuffed full. A four-drawer cabinet can weigh over 50 kilograms! Downsizing your paperwork before you move is a wise way to lighten your load.

Types of Documents

Documents fall into four basic categories:

- Vital Records: You need these records to prove you exist (e.g. birth certificate), verify your social status (e.g. marriage licence), and authenticate what you own (e.g. stock certificates). You must keep Vital Records for life or as long as you own an item.

- Active Records: Active records are documents that you are working with right now. Your current electricity bill and your recent pay statement fall into this category. Once you take action on an active record, you can either recycle/shred or move it into the Inactive Record category.

- Inactive Records: These records are documents that you have finished working with but still need to keep for a defined period of time. Inactive records include your previous years’ income tax returns and instruction manuals for items you own.

- Archives: Archives are not inactive records. Your archives contain information that you want to keep forever, usually for sentimental reasons. These types of documents might include personal correspondence and memorabilia.

What Do I Keep and What Do I Toss?

The hardest thing for many people is figuring out what to keep and what to toss. If you keep everything, your home will be full of heavy over-stuffed filing cabinets. Tossing everything out may mean you lose irreplaceable documents. In government and industry, policies explain how long documents need to be retained. These policies build a retention schedule. You can make your own retention schedule to simplify decision-making when downsizing your paperwork at home.

Building a Retention Schedule

It takes a little time to build a retention schedule. There are no “hard and fast” rules about what you need to keep and how long you need to keep it because document retention varies by locality. And everyone has a slightly different personal situation too. However, there are guidelines. For example, the Canada Revenue Agency recommends keeping personal income tax records for six years from the date you file that return. But, if you have a home business or have claimed capital gains, you might have to keep your records longer than six years. How do you find out the right answer? Consult with trusted legal and financial professionals for advice specific to your situation. If you own a business, check with WorkBC and your industry association for guidelines in those areas. Remember: If you find two sources that recommend different retention periods, keep the records for the longer period.

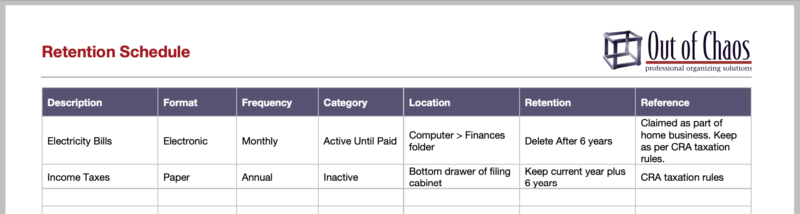

Sample Retention Schedule

Below you’ll see an example of a retention schedule. It tells what the records are and where you can find them. It explains how long you need to keep the records and the reference for the recommendation. I created a template for you to get started. Download the PDF here.

Begin Downsizing Your Paperwork

Now that you know what you need to keep and for how long, you can start to downsize your paperwork. It’s best to separate your documents into piles:

Vital Records: When you find these documents (birth certificates, wills, deeds, stock certificates, etc.), you may want to keep them in a fireproof safe or a safety deposit box at your local bank.

Active Records: Keep these organized at your desk in a priority action system until you’ve taken action on these tasks. Then they will move to the Inactive Records section.

Inactive Records: Batch your inactive records according to the date you need to dispose of them. For example, you determine that you can destroy your income tax records after seven years. Therefore in 2020, you can shred your income tax documents dated before 2014. Before dumping everything in the shredder, take a quick look to see if you have overlooked anything important. Sometimes a birth certificate or investment record can get stuck between two other papers. It’s best to make sure.

Archives: Ideally, it would be best to store your archives separately from your day-to-day records – even the inactive ones. Since you are keeping these records forever, take some time to ensure they will endure for years to come. For this reason, store them in archival-quality sheet protectors and place them in an archival-quality document box.

Build a New Filing System using FreedomFiler®

At Out of Chaos, we love the FreedomFiler® filing system for its plug-and-play ease of implementation. It simplifies your record-keeping because it uses a colour-coded filing system. Also, it stores your records according to the length of time you need to keep them. It is an auto-downsizing system and self-purging. You can remove outdated documents with only a brief review at the same time as you file new records.

- Vital Records are kept in red tabbed folders to indicate they are “permanent files.” Keep these documents for the lifetime of a person or property. If you need to pass them on to a new owner, you have them at hand. Also, your trustee or executor can find them easily.

- Inactive records are kept in two sections. “Replaceable files” hold documents until you replace them with a newer version. “Rotating files” are continually emptied and reused over the year.

Once you implement the FreedomFiler system, there will be no need for a big “downsizing your paperwork” day (or week!). You will only have the records you need, and you will be able to quickly and easily find them.

If you need help downsizing your paperwork or are interested in the FreedomFiler® system, contact Linda today through the website.